Energy Sets Up Near Major Resistance – Breakdown Pending

Our research team believes Crude Oil and Energy, in general, has stalled near major resistance and maybe setting up a big downside move as the COVID-19 virus continues to roil regional and global economies.

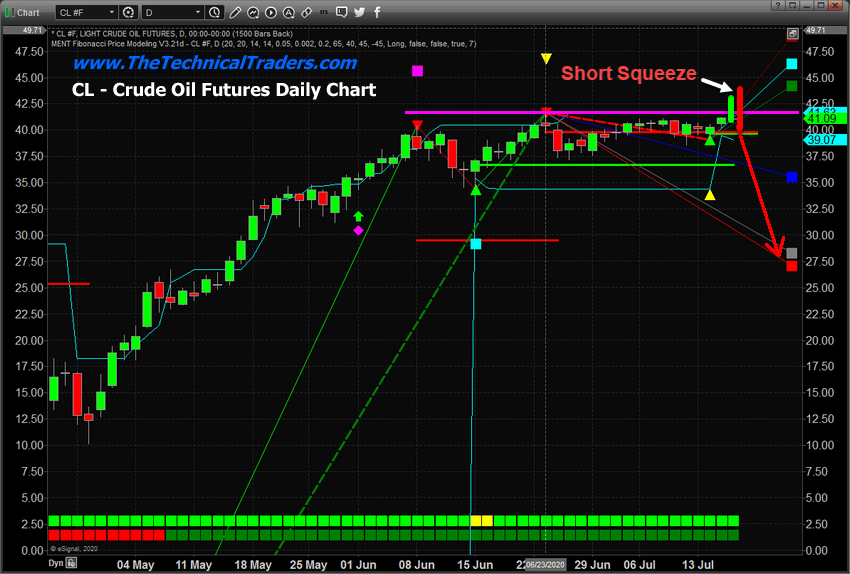

The recent news that the COVID-19 virus cases have skyrocketed suggests further economic shutdowns may push oil prices below $35 ppb over the next few weeks and months. Our researchers believe Oil has already set up a resistance level near $42 and will begin to move lower as concerns about the economic recovery transition through expectations related to oil demand going forward. We believe the renewed global economic demand for oil will present a very real possibility that oil could collapse below $35 ppb over the next 30 days.

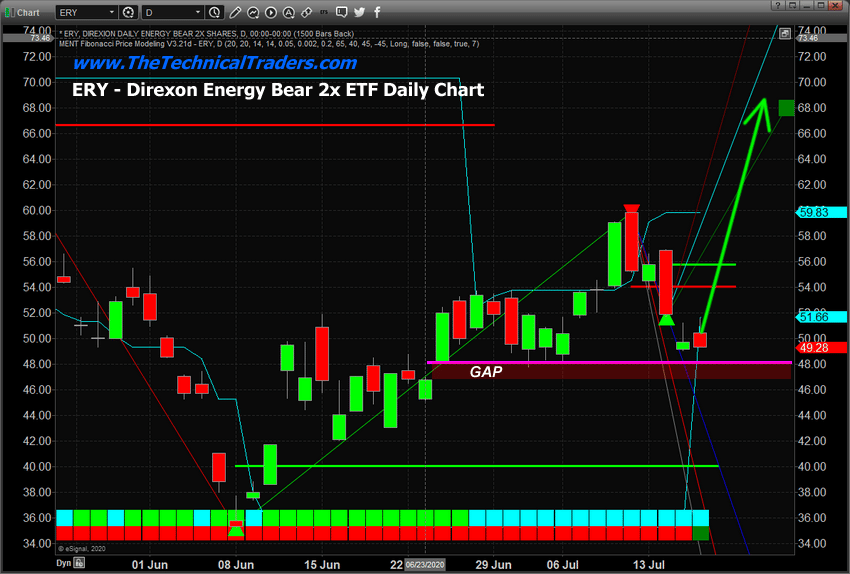

We believe this pending downside move in Crude Oil will set up a great trade opportunity in ERY, the Direxion Bear Energy 2x ETF. At this point in time, we are just waiting for the technical confirmation of this trade trigger. Once we receive confirmation from our price modeling systems, we believe ERY may rally 20% to 30% or more from current levels.

Before you continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

Our research team believes Crude Oil’s inability to rally above $42 recently suggests strong resistance exists near the $42 level. There could be a short squeeze in price where oil pops to $44-45 and then reverses quickly below $41, which would be a great sell signal for falling oil.

We believe Q3 will present a very real opportunity for oil to fall below $35 ppb over the next few weeks. Possibly moving much lower – below $30 ppb. Once this move confirms, we’ll have the opportunity to jump into the ERY trade where we may attempt to capture 20% or more on a quick technical trade.

Our proprietary Fibonacci Price Modeling system is suggesting an initial upside price target for ERY near $68. This suggests a potential 35% upside price move in ERY is Crude Oil Collapses as we expect. This presents an excellent trading opportunity for skilled technical traders.

As we wait for Crude Oil to breakdown, traders should watch the GAP below $48 as a potential deep price support level in ERY. The upside potential profits for this trade is still rather substantial. We just need to wait for the proper technical confirmation for this setup because news or any geopolitical events could dramatically change expectations for Crude oil.

Get our Active ETF Swing Trade Signals or if you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we are about to issue a new signal for subscribers.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.

NOTICE: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only. Our research team produces these research articles to share information with our followers/readers in an effort to try to keep you well informed.