Investors Who Are Liquidating To A Cash Position – What To Do Next?

Bank of America, Michael Hartnett, Chief Investment Strategist recently stated, “The bear-market rally for stocks has disappeared as investor concerns about inflation and interest rates linger.” “We’re in a technical recession but just don’t realize it.”

Freight Waves, Henry Byers reported, “US import demand is dropping off a cliff as inbound container volumes to the US are reverting to pre-pandemic levels.” Byers went on to say that “The consumer is getting crushed as conditions for the consumer seem to be getting worse and worse as inflation takes hold and prices get more and more expensive.”

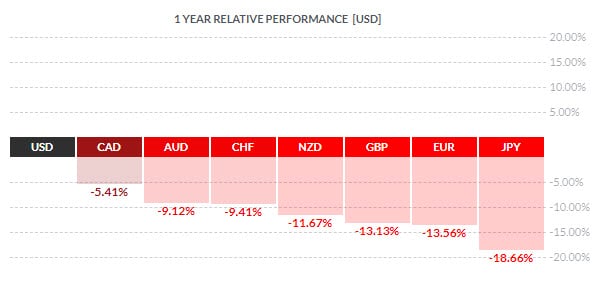

We have quickly moved from seeing the dark clouds on the horizon to the start of entering the initial storm wall. The USD put in a major low on January 6th, 2021. Since then it has been in a strong uptrend as global investors seek safety with the uncertainties about geopolitical events, record inflation, rising interest rates, slowing housing, plummeting auto sales, increasing retail inventories, expanding consumer credit, and pending layoffs.

Source: www.finviz.com

US DOLLAR ETF: UUP +16.69%

UUP remains in its uptrend as the price continues to move up from its base of accumulation.

After having a brief 2-week pullback of -3.45% UUP has found support and is now looking to extend its bull market trend.

Investors who are liquidating stocks and moving to a cash position could consider UUP to capitalize on the strengthening US Dollar.

INVESCO DB USD INDEX BULLISH FUND ETF • UUP • ARCA • DAILY

20+ YEAR TREASURY INVERTED ETF: TBF +38.89%

TBF remains in its uptrend as the price continues to move up from its base of accumulation.

After having a 3-week pullback of -6.21% TBF has found support and is now looking to extend its bull market trend.

Investors who are liquidating stocks and moving to a cash position could consider TBF to capitalize on the FED raising interest rates to try and curb inflation.

PROSHARES SHORT 1X 20+ YEAR TREASURY ETF • TBF • ARCA • DAILY

S&P 500 SHORT INVERTED ETF: SH +19.33%

SH remains in its uptrend as the price continues to move up from its base of accumulation.

After having a 2+-week pullback of -7.19% SH has found support and is now looking to extend its bull market trend.

Investors who are liquidating stocks and moving to a cash position could consider SH to capitalize on the falling stock market.

PROSHARES SHORT 1X S&P 500 ETF • SH • ARCA • DAILY

VALUABLE INSIGHTS FROM SUCCESSFUL TRADERS

Market Wizards by Jack D Schwager (www.Amazon.com) is packed with insights from successful traders who have shared their wisdom based on firsthand trading experiences. Here are a few of our favorites:

Paul Tudor Jones:

- “If you have a losing position that is making you uncomfortable, the solution is very simple; get out, because you can always get back in.”

- “There is nothing better than a fresh start.”

Ed Seykota:

- “There are old traders and there are bold traders, but there are very few old, bold traders.”

- “Losing a position is aggravating, whereas losing your nerve is devastating.”

- “Good traders; Many are called, and few are chosen.”

Larry Hite:

- “We always follow the trends, and we never deviate from our methods.”

- “I have two basic rules about winning in trading as well as in life; If you don’t bet, you can’t win.”

- “If you lose all your chips you can’t bet.”

WHAT STRATEGIES CAN HELP YOU NAVIGATE THE CURRENT MARKET TRENDS?

Learn how we use specific tools to help us understand price cycles, set-ups, and price target levels in various sectors to identify strategic entry and exit points for trades. Over the next 12 to 24+ months, we expect very large price swings in the US stock market and other asset classes across the globe. We believe the markets have begun to transition away from the continued central bank support rally phase and have started a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern begin to drive traders/investors into Metals and other safe-havens.

Historically, bonds have served as one of these safe-havens. This is not proving to be the case this time around. So if bonds are off the table, what bond alternatives are there? How can they be deployed in a bond replacement strategy?

Sign up for my free trading newsletter so you don’t miss the next opportunity!

We invite you to join our group of active traders who invest conservatively together. They learn and profit from our three ETF Technical Trading Strategies which include a real estate ETF. We can help you protect and grow your wealth in any type of market condition. Click the following link to learn more: www.TheTechnicalTraders.com

Chris Vermeulen

Chief Market Strategist

Founder of TheTechnicalTraders.com