Revisiting Our October 23 Four Stocks To Own Article – Part I

Just before the US Elections, we authored an article related to four stocks/sectors that we thought would do well immediately after the November 2, 2020 elections. The article highlighted how sector rotation in almost any market trend can assist traders in finding solid trading triggers. We picked four stocks from various sectors for this example:

| AAL | American Airlines | Travel/Leisure |

| ACB | Aurora Cannabis | Cannabis |

| GE | General Electric | Industrial/Specialty Industry |

| SILJ | Junior Silver Miners ETF | Precious Metals Miners |

When you review my Yahoo! Finance article from October 23 and the November 6 follow up article related to these stock picks, you will quickly see that all of these stocks exhibited similar types of technical patterns. They were all bottoming in an extended rounded bottom formation and had all started to near a Pennant/Flag Apex in price. Additionally, many of them, with the exception of SILJ, had set up a very clear RSI technical divergence pattern over the course of setting up the extended bottom in price.

My research team and I selected these stocks because of key expectations related to the post-election mentality of investors related to various sectors. First, the cannabis sector had a number of new US states approve cannabis legislation – providing for an expected increase in business activity for the entire cannabis sector. Second, no matter who won the election, another round of stimulus was likely to be approved resulting in increased economic opportunity for companies like GE and AAL. The Travel and Leisure sector still had its risks as a surge in COVID cases could greatly disrupt future travel expectations. Junior Silver Miners was our “hedge trade”. If none of these other stocks started to rally, then Silver Miners would likely move 15% to 20%+ higher over time.

We thought it would be a good time to check in with our picks to share the importance of using sector trends to your advantage. Currently, there are dozens of sectors that are either in a solid bullish trend or are shifting into new bullish trends. Being able to catch these setups early and having the confidence to act on these trends is very important. We highlighted some of these setups in our October 23 article, but they happen all the time in various market sectors.

What is important is being able to see the setups, identify the sectors that have the strongest capability for future trends, then determining if you should trade the Sector ETF or some individual stocks within that sector. Generally, the Sector ETFs provide enough liquidity and opportunity that you don’t need to worry about the individual stocks. Yet, sometimes, applying the same techniques to the strongest sector stocks can add a very valuable component to your trading.

Below, we have highlighted the accomplishments of each stock symbol over the past 60+ days. For this example, we will estimate a $20k allocation for ALL TRADES ($5k each) and use a simple 33% target allocation for Target 1, Target 2, and the Trailing Remainder. That means, we take 33% of the position off at Targets 1 and 2, then let the remaining 33% trail with a protective stop.

| Symbol | Entry Price | Target 1 % | Target 2 % | Last Price % |

| AAL | $12.60 | 39.81% | NA | 22.44% |

| ACB | $4.68 | 124.35% | NA | 114.72% |

| GE | $7.63 | 22.77% | NA | 48.56% |

| SILJ | $14.68 | NA | NA | 10.11% |

Our $20k sample account would look something like this right now…

| Symbol | Entry Price | Target 1 $ | Target 2 $ | Last Price $ |

| AAL | $12.60 | $656.87 | NA | $6,408.61 |

| ACB | $4.68 | $2,068.28 | NA | $10,802.59 |

| GE | $7.63 | $375.71 | NA | $6,995.44 |

| SILJ | $14.68 | NA | NA | $5,505.50 |

| Total => | $29,712.14 |

Overall, this represents a +48.5% net account profit in just over 60 days by focusing on sector trends and rotations. In the future, if any of our higher Target levels are reached, we’ll pull another 33% of these trades and lock in these gains while we let the remaining position carry forward with a trailing stop. The trailing stop should be based on the last completed target level reached. For example, if Target 1 is reached, then the stop should be placed just below the Entry Price level. If Target 2 is reached, then the stop should be placed just below the Target 1 level and it should begin to trail higher as new price highs are reached.

Usually, we will pick an exit price level based on some type of trend failure or reversal point. In most cases, this happens when the longer-term (Weekly based) moving averages change direction and price activity displays a clear technical pattern showing the bullish trend has ended. Most traders are capable of determining their own exit points using technical indicators and other tools as they wish.

Be sure to sign up for my FREE webinar that will teach you how to find and trade my BEST ASSET NOW strategy on your own!

When some sector is trending very strongly, we don’t want to attempt to second guess the peak level or end of the trend. We just want to ride that trend for as much profit as we can – unless some other sector sets up a new opportunity where we can better deploy our assets for profits. We like to let the trend work itself to an eventual end and use our Target Levels to lock in gains along the way.

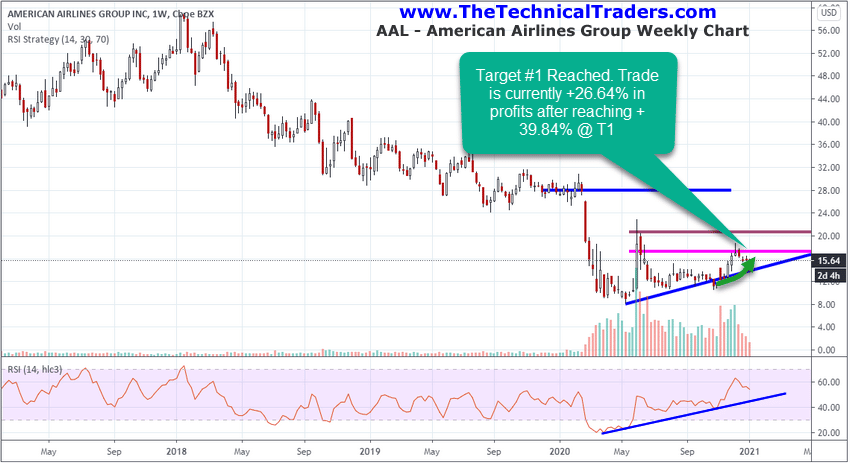

American Airlines Trade

The following Weekly chart of American Airlines (AAL) highlights the simple trade we suggested on October 23, 2020. As you can see, the upward sloping lows in price aligned with the upward sloping RSI trend (in the lower pane). AAL has reached our first target level (the MAGENTA line) and has recently settled near $15.13. Our stop level should be just below our entry price level, near or below $12.60 at this time as we wait to see how the bullish trend continues.

In Part II of this article, we’ll go over the remaining three stock symbols we initially suggested on October 23, 2020 and highlight even more details related to sector trending.

Many years ago I was researching Japanese Candlesticks and the teaching of Seiki Shimizu (The Japanese chart of charts: Shimiz) settled well with my thinking. In his writing, he suggests that more than 60% of the time traders are waiting for new setups/trades. This is something that many traders need to fully understand in order to balance aggressive trading tendencies with their abilities to create profits and protect assets.

If this theory is correct, then trades only need to focus on the 30% to 40% of any 12-month span of time (three to four months) where the bigger sector trends/trades setup and initiate. Otherwise, these trends may continue, in some form, over the remainder of the time to generate profits (or not). This type of thinking suggests that traders only need to focus on the best immediate setups in any market trends/sectors and ignore the “froth” in the markets on a day-to-day basis. Doing so will allow most traders the freedom to create profits by taking skilled and effective entry triggers while being able to enjoy life, family, and other hobbies.

Trading does not need to be a full-time, 24/7 effort. The global markets generate big sweeping sector trends sometimes 2 to 4 times a year as capital moves in and out of various trend cycles (short, intermediate, and long term). All we have to do is find the best sectors to trade, then wait for the trigger/entry setup. Now, imagine what it would be like if you could accomplish something like this every week or month with technology? You can with my BAN Trader Pro strategy and Hotlist.

BAN Trader Pro can help you identify and trade the Best Asset Now. The BAN Hotlist helps us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the BAN Trader Pro system trades. You owe it to yourself to see how simple it is to profit from sector rotation with my strategy. You can sign up here for my 100% educational webinar for free.

Have a great week!

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com