US vs. Global Sector Rotation – What Next? Part II

In Part One of this research post, we highlighted and discussed the many geopolitical and economic factors that are driving the market price volatility over the past 30+ days in addition to highlighting some of the key elements/factors of the next 15+ days that may continue to drive market volatility higher. The three key elements we discussed were the US Presidential Elections, the European Elections (European Union Elections) and the US/China Trade Discussions. Each of these components is big enough to reflect many trillions of dollars in economic output and, individually, each of these components could drive increased price volatility over the next 30+ days. Combined, should these events somehow combine into a massive disruption event, they could break the backbone of the global markets in such a way that many investors are simply not prepared to discuss or trade.

In our opinion, there are a number of elements to the unfolding global market economics that play into our future expectations. China becomes one of the biggest unknowns simply because we believe the best information we have at the moment is shaded and hidden in terms of true values. Let’s take a minute to discuss a few of them…

First, the currency markets are the first area that moves to protect against fears and risks (https://www.scmp.com/economy/china-economy/article/3010364/will-falling-yuan-torpedo-chinas-trade-talks-us). The FOREX ratios operate as an immediate hedge against debt, credit and future expectations. The recent decline of the Chinese Yuan represents a massive danger for the Chinese government. Not only does this create an issue for the population of China, seeing their purchasing power diminish, but it also creates a debt servicing issue for business, corporations, and government on a massive scale. Servicing their foreign debts just became much more expensive as the Yuan value decreases compared for other foreign currency levels.

Second, falsified corporate accounts/book and statements of cash balances are not something new for the Chinese (https://www.scmp.com/business/banking-finance/article/3010713/chinese-msci-constituent-firm-kangmei-pharmaceutical-faces). We have first-hand experience from back in the early 1990s that these false books are fairly common “standard operating procedures” for many Chinese. It would not surprise our research team is many of the economic numbers and corporate balance sheets are completely made up. We believe this practice of creating a false economic support system will implode and more and more pressure is exerted onto China’s economy.

Third, the pressures put on the Chinese economy not only by the US trade tariffs but also by the Chinese people and government may open up massive cracks in the Chinese population in terms of trust and support for Xi and the bigger plans for China. Our sources are suggesting that much of the animosity currently in China is directed at the US and President Trump for the current trade issues. Our belief is that as more and more evidence becomes available and more and more Chinese people see what their government has created in terms of real opportunity and leadership, we believe an “awakening process” will take place to expose corruption, criminal activities and much more. Simply put, the Chinese people are mostly unaware of the levels of corruption and falsified numbers. They have been running on the premise that Xi and the Chinese leadership were executing a flawless success plan. When the real numbers come out, pushed into reality because of a contraction in economic “slush money”, the likelihood of a populous revolt is fairly strong (https://www.scmp.com/business/companies/article/3010621/brutal-interventions-sanpowers-debt-workout-show-why-chinas)

Lastly, it appears many of the bigger Chinese firms have enough reserve capital to weather the Trade issues and survive (https://www.scmp.com/business/companies/article/3010280/chinas-biggest-companies-can-weather-us-china-trade-war), yet our resources are telling us the people in the bigger cities of China are already feeling the pain of the trade tariffs. Many are reporting being suddenly laid-off as the very real threat of consumer inactivity sets in throughout most of China. One of the first things to happen when an economy is under threat or contracts is that consumers move into a protectionist stance. Consumers cut back spending, investment, and many external activities while attempt to protect their capital from unknown risks. As the contraction continues, consumers cut back even further attempting to protect assets that are valuable or essential. Their natural reaction is to spend only on essential items and to protect value in assets.

Should some unsettling economic event push the Chinese markets into a collapse mode, we are certain the US market would react as well. The strength of the US Dollar may come under some pricing pressure as investors revalue the true strength of the US Dollar as well as the continued global economic outcome. It is very likely that the US stock market would retrace lower as this even unfolds and that the US Dollar would rotate a bit lower as global investors search to identify true valuation levels for the global markets.

We don’t expect the Chinese markets to collapse over the next 10 to 20+ days, as we are suggesting, but we do expect continued political positioning and news to become a driving a force of extended market volatility.

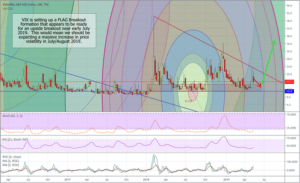

The VIX has settled into a Pennant/Flag formation that suggests a July/Aug 2019 breakout may be very likely. This aligns with much of our other research to suggest that a July/Aug rally in Precious Metals is very likely as well. The combination of a VIX rally along with a Precious Metals rally suggests a moderately strong downward price rotation in the US and global stock markets that may begin near the end of July or early August 2019.

The likelihood of a continued increase in price volatility seems like a sure thing over the next few months. EU Elections, US/China trade issues, the US Presidential elections, and many additional geopolitical events seem to coalesce into a new perfect storm for price volatility.

In Part III, we’ll highlight sectors of the US stock market that may be partially immune from this price volatility and try to help traders identify and understand how to prepare for a VIX Spike and the volatility that will follow.

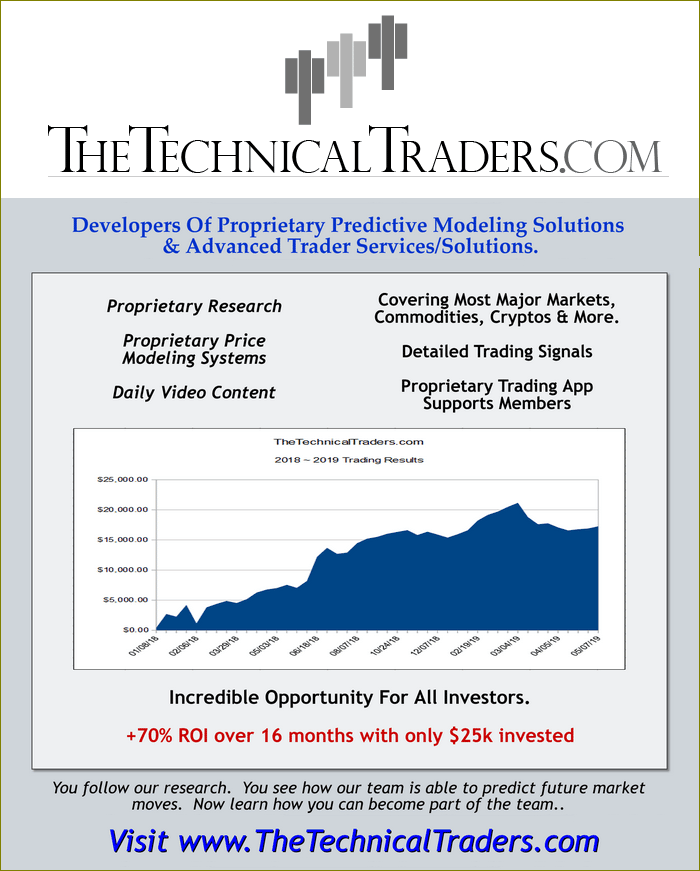

This is proving to be an incredible trading year for traders who follow our trade alerts newsletter.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is exactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have a few more left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Chris Vermeulen